Net Working Capital Ratio Calculator - Glossary:

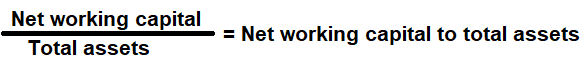

Net Working Capital Ratio: Shows the proportion of short term net funds to assets. In simple words, it is a measure to know, if a company is gradually shifting more of its assets into or out of long-term assets.Formula:

How to use this equation?

This is a balance Sheet component; the values are commonly stated against Current Assets, Current Liabilities and Total Assets. To use this ratio, First obtain the working capital value by subtracting current liabilities from current assets and then divide it with total assets.Note:

Net Working Capital = total current assets - total current liabilities.

It is a liquidity calculation that measures a company’s ability to pay off its current liabilities with current assets.

Current Assets:

This is a balance sheet component - cash, cash equivalents, account receivables, merchandise inventory and marketable securities can easily be converted into cash in the short term.

Current Liabilities:

This is a balance sheet component - accounts payable, tax payable (sales, payroll and other taxes) that are due in short-term.

Total Assets:

Total assets are the sum of all current and noncurrent assets that a company owns.

Example:

Net working capital ratio for a company with total current assets of $180,000, current liabilities of $85,000 and total assets of $220,000 is 0.43:1 or 43% indicating that the company has additional liquidity and financial strength to meet its working capital requirement.