Earnings Per Share Ratio Calculator - Glossary:

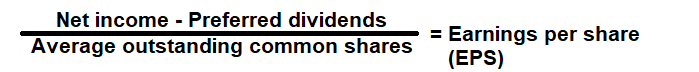

Earnings Per Share Ratio: Earnings per share denotes the money you would earn for owning each share of common stock.Formula:

How to use this equation?

The values are commonly stated against Net Income and preferred dividend in the income statement and the weighted average shares outstanding in the balance sheet. To use this ratio, subtract the dividends paid out to preferred shareholders from the net income. Then, divide that value by average shares outstanding.Net Income:

Profit before deducting all its interest & taxes.

Preferred Dividends:

Preferred dividends are cash distributions that are paid to the owners of a company's preferred shares.

Weighted Average Share Outstanding:

Weighted average shares outstanding is a calculation that incorporates any changes in the number of outstanding shares over a reporting period.

Example:

A company with a net income of $160,000 pays out $10,000 in dividends to preferred shareholders and has a weighted average share outstanding - 50,000, then its earnings per share (EPS) will be $3.