Price to Earnings (P/E) Ratio Calculator - Glossary:

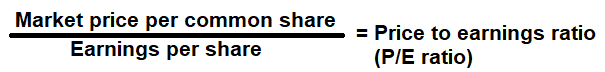

Price to Earnings (P/E) Ratio: Price to Earnings (P/E) Ratio are used to measure the market price of company's stock market price to its reported earnings.Formula:

How to use this equation?

The values are commonly stated against Net Income and preferred dividend in the income statement and the weighted average shares outstanding in the balance sheet. To use this ratio, to use this ratio, divide the market price per share by the company's earnings per share.Note:

Earnings Per Share = (Net Income - Preferred Dividends)/Weighted Average Shares Outstanding The values of Net Income and preferred dividend from the income statement and the weighted average shares outstanding from the balance sheet.

Stock Price:

The amount of money it will cost to purchase a share of a company through a stockbroker from secondary market.

Earnings Per Share:

It is portion of a company's profit that is allocated to each outstanding share of its common stock.

Example:

Price to earnings (P/E) ratio for a company with a net income of $800,000, dividends pays out of $50,000 and a weighted average share outstanding of 75,000 with market price of $50 per share is 5 times. It means that, company stock is trading at a multiple of 5.