Gross Profit Margin Ratio Calculator - Glossary:

Gross Profit Margin: Shows the proportion of Net Sales to Gross Profit. In other words, the amount of money left over from sales after deducting the cost of goods sold (Direct expenses).

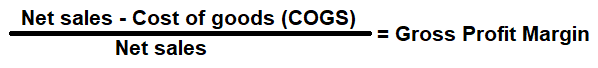

Formula:

How to use this equation?

This is an Income statement component; the values are commonly stated against net sales (earnings) and cost of goods (COGS). To use this ratio, subtract cost of goods from net sales to arrive at the gross margin. Then divide gross margin by net sales.Net Sales:

Total sales less returns and bad debts.

Cost of Goods:

Cost of goods sold (COGS) is total cost to produce goods and services such as cost of materials, wages and other expenses related to producing a goods and service.

Example:

Gross profit margin for a company with a net sales income of $100,000 and Cost of goods sold (COGS) of $30,000 is 70%. It means the company profits $0.50 for each dollar of it generated, or we can say that, company has 70% of its sales income to cover its operating expenses.