Return on Equity Ratio Calculator - Glossary:

Return on Equity:

Shows the proportion of net income to its total shareholder’s equity.

In simple words, it is used to measure the company's ability to generate profits from its shareholders investments.

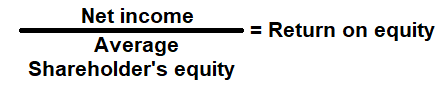

Formula:

How to use this equation?

The values for net income can be obtained from income statement and total shareholder's equity value from the balance sheet. To use this ratio, divide the net income with average total shareholder's equity.Note:

Average shareholder's equity: Add the total shareholder's equity from current year and the previous year, and then divide the sum by 2.

Net Income after tax:

Profit left over after deducting all its expenses (cost of goods, operational expenses, interest cost, depreciation cost, taxes and if any dividend paid).

Total Shareholder's Equity:

Total shareholder's equity is the value left in the company after subtracting total liabilities from total assets.

Example:

Return on equity ratio for a company with net income of $60,000 and total shareholder’s equity of $600,000 is 10%. It means that, a company yields a return of $0.10 per dollar for its shareholder's equity investment.