Return On Total Assets(ROTA) - Glossary:

Return on Total Assets: The return on total assets compares the earnings of a business to the total assets invested in it.It shows how effectively a company uses its assets to generate earnings.

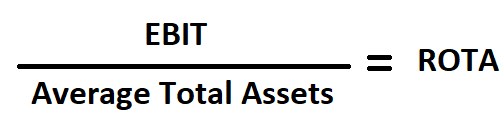

Formula:

How to use this equation?

This is an income statement component; the values are commonly stated against EBIT and Total Assets is a balance sheet component. To use this ratio, divide EBIT by the average total assets each year, or for the trailing twelve-month period if the data is available.Earnings Before Interest and Taxes(EBIT):

Earnings before interest and taxes is a calculation of the operating earnings of a business. it specifically excludes interest, which is a finance cost, and taxes.

Average Total Assets:

Total assets are the sum of all current and noncurrent assets that a company owns. Total assets include contra accounts for this ratio, meaning that allowance for doubtful accounts and accumulated depreciation are both subtracted from the total asset balance before calculating the ratio.

Example:

Return on total assets for a company with EBIT of $140,000 and total average of total assets of $4,000,000 is 3.5%. Ratio of 3.5% means that for every dollar worth of asset, the company generates $3.5 or 3.5 times.